Home

Blockchain infrastructure for enterprises

Global leaders in financial services use Paxos’ platform and APIs to build their blockchain and digital asset solutions.

TRUSTED BY

TRUSTED BY

DESIGNED FOR ENTERPRISES

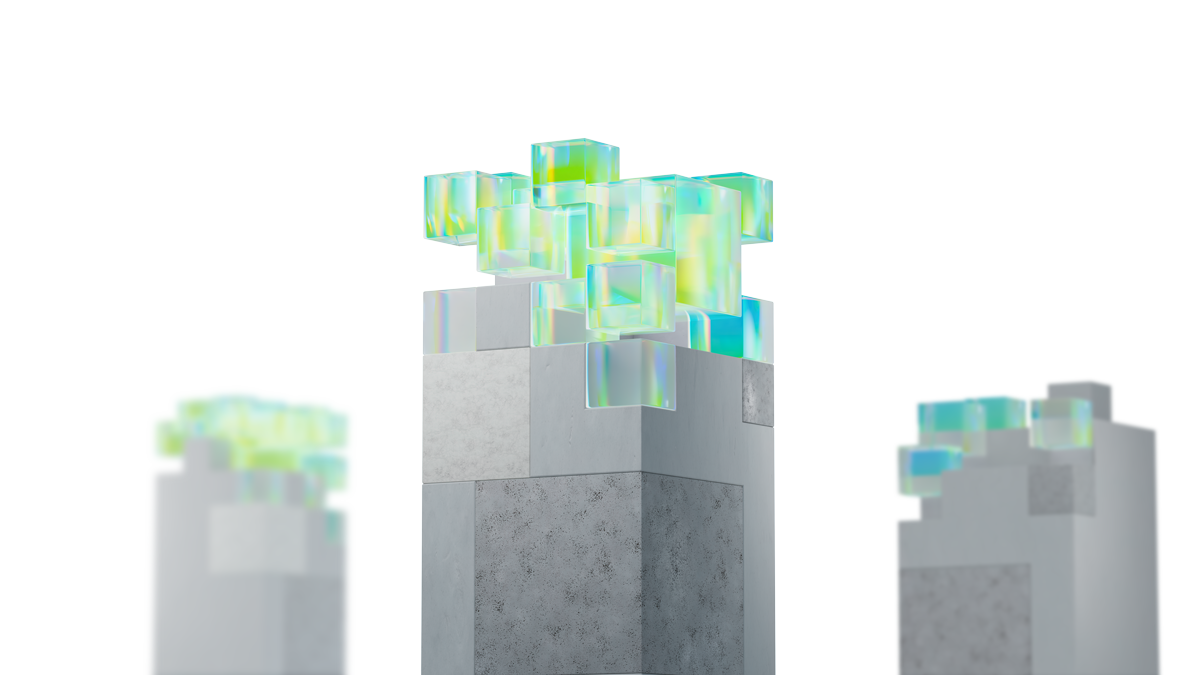

A suite of regulated

blockchain products

LEGALLY PROTECTED

Regulated, fully-backed digital assets

Paxos-issued digital assets are backed by 1:1 redemption, held bankruptcy-remote and regulated by the New York Department of Financial Services. View reports.

TRUST & TRANSPARENCY

Technology built within global regulatory structures

Paxos maintains the highest commitments to regulation, compliance and transparency in the industry

2015

New York Limited Purpose Trust Charter from the NYDFS

2022

Licensed as a Major Payments Institution with the Monetary Authority of Singapore

Play Video

INSIGHTS ON THE FUTURE OF FINANCE

Access thought leadership on the future of blockchain and tokenization

PAXOS MAKES IT POSSIBLE

We’re harnessing blockchain to build infrastructure that enables enterprises to bring-to-market innovative products that will power the financial markets of tomorrow.

Let’s build it together.

Play Video

Get started with Paxos

Explore how Paxos can help your company launch innovative, regulated and blockchain-based financial solutions